Table Of Content

- Explore personal banking

- What is a mortgage refinance?

- Majority of rates increase Current mortgage rates for April 24th, 2024

- Rates rise Mortgage rates for today, April 22, 2024

- High-Yield Savings Account Rates Today: April 25, 2024

- Compare CA mortgage rates by loan type

- Rates increase Mortgage rates for today, April 25, 2024

Please contact us in order to discuss the specifics of your mortgage needs with one of our home loan specialists. A home loan with an interest rate that remains the same for the entire term of the loan. Mortgage rates should go down later this year, increasing affordability for many hopeful homebuyers. NAR expects that rates will fall to 6.5% by the end of 2024, according to its latest forecast, and that existing-home sales will increase 9%.

Explore personal banking

In QE, the Federal Reserve purchases longer-term securities from the open market in order to encourage lending and investment by increasing the money supply. In addition, this strategy of bidding up fixed-income securities also serves to lower interest rates. The lender should send you a loan estimate with your pre-approval, which is a document that gives you information about the loan you would likely qualify for. Loan estimates all use the same format and make it really easy to compare loans, so if the lender doesn't send it with your pre-approval notification, ask for one. Many or all of the products here are from our partners that compensate us. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation.

What is a mortgage refinance?

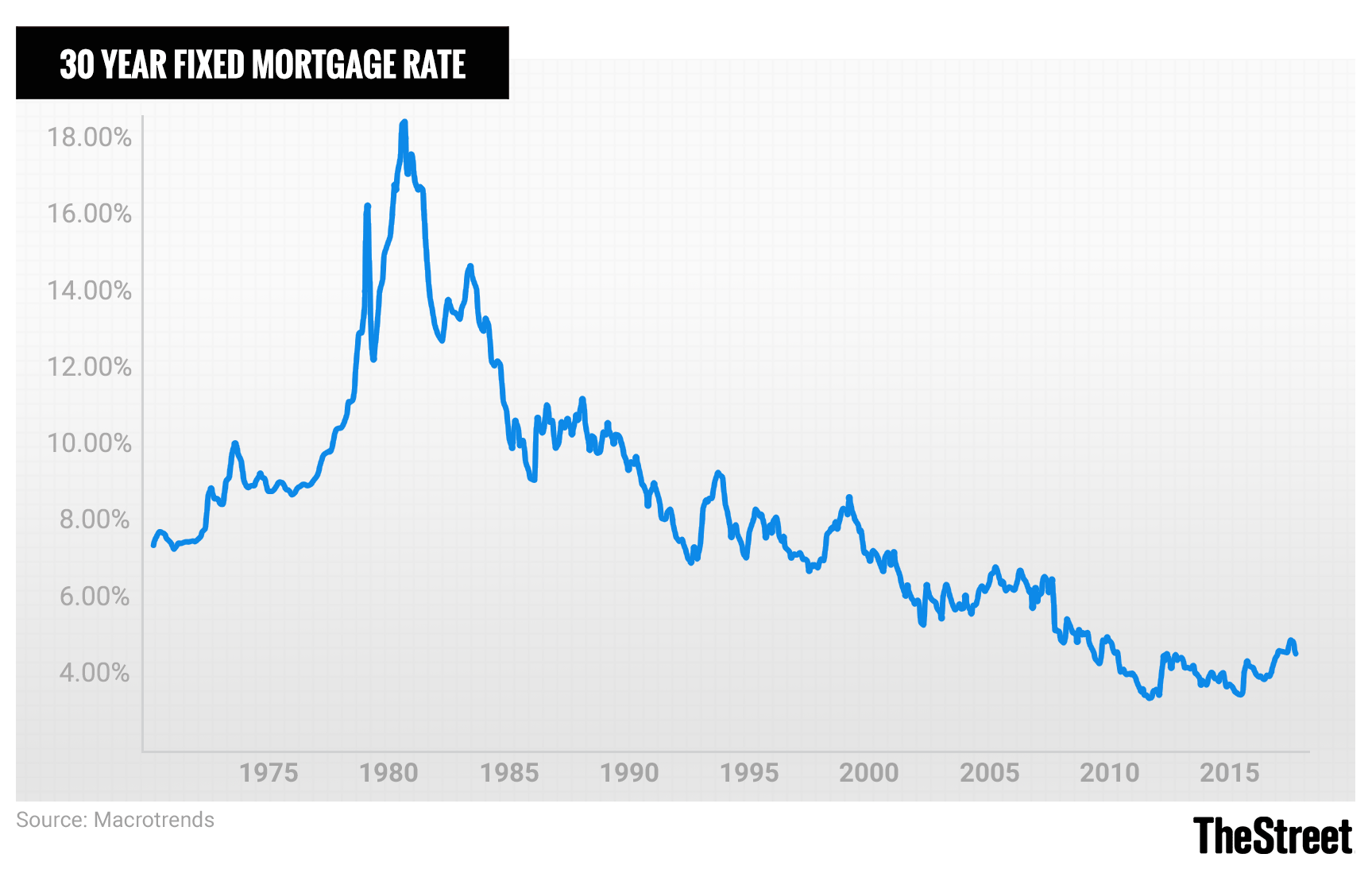

Mortgage rates started ticking up from historic lows in the second half of 2021 and increased over three percentage points in 2022. Rates also increased dramatically last year, though they trended back down toward the end of 2023. Click "More details" for tips on how to save money on your mortgage in the long run. This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there.

Majority of rates increase Current mortgage rates for April 24th, 2024

Predictions indicate that home prices will remain elevated throughout 2024 while new construction continues to lag behind. This will put buyers in tight housing situations for the foreseeable future. In this example, if your budget is $2,000 per month and rates rise to 9%, you might have to shop for a home with a lower price tag.

Lauren Graves is an educator-turned-editor specializing in personal finance content. She seeks to make complicated topics easier to understand and less intimidating to the average reader with accurate, reliable information and transparent writing. Her expertise includes banking product reviews and general topics universal to personal finance such as saving and budgeting. Her work has been featured in Money Under 30, Investor Junkie, Doughroller, Saving for College and APY GUY. Curinos determines the average rates for savings accounts by focusing on those intended for personal use.

Whether or not 2024 will be a good time to refinance depends on several factors, including if the Fed cuts interest rates this year and by how much. The mortgage rate you got when you financed your home is another major factor. Homebuilders have been able to mitigate the impact of elevated home loan borrowing costs this year by offering incentives, such as covering the cost to lower the mortgage rate home buyers take on. That’s helped spur sales of newly built single-family homes, which jumped 8.8% in March from a year earlier, according to the Commerce Department. Pending home sales increased 3.4% on a monthly basis in March, according to the National Association of Realtors. However, NAR chief economist Lawrence Yun said in a press release that these sales have remained within a "fairly narrow range" over the last year.

Compare CA mortgage rates by loan type

The 30-year jumbo mortgage rate had a 52-week APR low of 5.00% and a 52-week high of 10.50%. In total interest, you’d pay $155,400 over the life of the loan. The current national mortgage rates forecast indicates that rates are likely to remain high compared to recent years, but could trend closer to 6% if inflation continues to decrease in 2024.

Best Home Equity Loan Rates of April 2024 - MarketWatch

Best Home Equity Loan Rates of April 2024.

Posted: Wed, 24 Apr 2024 07:00:00 GMT [source]

Rates increase Mortgage rates for today, April 25, 2024

The current average mortgage rate on a 30-year fixed mortgage is 7.57%, according to Curinos. The average rate on a 15-year mortgage is 6.79%, while the average rate on a 30-year jumbo mortgage is 7.55%.Current Mortgage Rates for April 15,... The current average mortgage rate on a 30-year fixed mortgage is 7.65% with an APR of 7.67%, according to Curinos. The 15-year fixed mortgage has an average rate of 6.86% with an APR of 6.89%.

Compare today’s refinance rates

Housing Market Predictions For 2024: When Will Home Prices Be Affordable Again? - Forbes

Housing Market Predictions For 2024: When Will Home Prices Be Affordable Again?.

Posted: Thu, 25 Apr 2024 16:49:00 GMT [source]

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. If you want to pay off a 30-year fixed-rate mortgage faster or lower your interest rate, you may consider refinancing to a shorter term loan or a new 30-year mortgage with a lower rate. The best time to refinance will vary based on your circumstances. Keep in mind that closing costs when refinancing can range from 2% to 6% of the loan’s principal amount, so you want to make sure that you qualify for a low enough interest rate to cover your closing costs.

As a result, a 15‑year mortgage has a lower interest rate than a 30‑year mortgage. Fed hikes have pushed mortgage rates up over the last two years. But the Fed has indicated that it's likely done hiking rates and could start cutting in 2024. Once the Fed cuts rates, mortgage rates should fall even further. Current HELOC rates are relatively low compared to other loan options, including credit cards and personal loans.

Most lenders offer several mortgage rates, depending on what your score is. Every lender decides what credit score will qualify for their lowest rate, but it's typically around 740. If your score isn't quite that high, you could still qualify for a good rate -- shop around with lenders to see. I’ve covered the housing market, mortgages and real estate for the past 12 years.

The gap that has jumped open between these two lines has created a nationwide lock-in effect — paralyzing people in homes they may wish to leave — on a scale not seen in decades. For homeowners not looking to move anytime soon, the low rates they secured during the pandemic will benefit them for years to come. But for many others, those rates have become a complication, disrupting both household decisions and the housing market as a whole. The rise in mortgage rates in recent weeks is an unwelcome trend for home shoppers this spring homebuying season. Sales of previously occupied US homes fell last month as home buyers contended with elevated mortgage rates and rising prices.

The latest uptick brings it to its highest level since Nov. 30, when it was 7.22%. ‘The average rate on a 30-year mortgage rose to 7.17% from 7.1% last week, mortgage buyer Freddie Mac said Thursday. In general, refinancing is worth it if you can save money or if you need to access equity for emergencies. When you’re shopping around, be sure to ask about any discounts—including appraisal waivers—that might be available to you. Some financial institutions offer discounts to existing customers; you might also find military discounts.

If you know how much you’re borrowing, what type of loan you’re getting and how many years you have to pay it back, you can use a mortgage calculator to check your monthly payment at different interest rates. A mortgage rate lock means that for a period of time, you'll get that interest rate even if market rates change before your loan closes. You can compare current mortgage rates between lenders by applying for mortgage pre-approval with each lender you're considering. “As inflation eases and the policy rate comes down, we should see 30-year fixed mortgage rates come down to the 5.5% to 6% range and remain around this range longer term,” she says. Demand for mortgages can also affect rates, pushing them higher as available capital for lending tightens.

If you don’t lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs. Mortgage rates are so high due to a number of economic factors. Supply chain shortages related to the pandemic and Russia’s war on Ukraine caused inflation to shoot up in 2021 and 2022.

No comments:

Post a Comment